- For those who have a good credit score and qualify for a beneficial http://paydayloancolorado.net/franktown financing having a 6% rate of interest, monthly installments would-be $111. The complete desire paid off is $step three,322.

- When you have a bad credit rating and qualify for a beneficial loan which have an effective 12% interest rate, monthly premiums was $143. The entire attract reduced was $seven,217.

As you can plainly see, high-attract funds can lead to higher monthly premiums and more attention paid than should you have a good credit score. Just like the home guarantee loan rates vary from the lender, look for a decreased interest.

If you find yourself a resident which have poor credit and would like to grab away a home collateral financing or HELOC, here are the actions you ought to decide to try incorporate. You can also notice that this process is much like trying to get other sorts of mortgage loans.

Determine how much you might use

The quantity you could borrow which have property equity financing or HELOC is bound so you’re able to the main collateral you possess of your house. To help you calculate this, influence your home really worth, then subtract their mortgage equilibrium.

Very, when your house is worthy of $eight hundred,100000 and you also are obligated to pay your own lender $110,one hundred thousand, you really have $290,100 inside the security. This is your LTV, otherwise loan-to-worthy of proportion. However, you can’t acquire brand new entirety on the equity; as an alternative, loan providers decrease their risk by only allowing you to borrow against a particular commission.

Shared loan-to-worthy of, or CLTV, ‘s the ratio evaluating the liens at your residence facing the market value. For every single financial possesses its own CLTV restriction, but 75% to 80% is normal. You could potentially acquire to $210,one hundred thousand facing your house should your lender’s CLTV limit was 80%.

Gather information regarding your current financial

Whenever obtaining property equity loan or personal line of credit, the possible financial will ask for all about your mortgage. Assemble so it documents beforehand so you’re able to improve the method to make the app circulate together less.

Help make your instance which have a page

Consider a proactive method when applying for a home guarantee mortgage since the a bad credit debtor. This may suggest creating a page getting potential loan providers ahead, explaining your role, and you can giving them some personal perception.

Such as for instance, when you yourself have bad credit on account of a divorce or separation or really serious illness, identify that. You can even need to offer records which could serve as then factor. This might were personal bankruptcy filing records, split up decrees, and.

Look around

Any time you are looking for a new mortgage, its wise to research rates. This helps remember to get the very best chance from the approval and therefore you’re likely to snag the finest prices and mortgage terms.

Shopping around having several lenders will provide you with particular choices to select from. Then you can contrast cost, fees, cost words, and you can mortgage restrictions to decide that provides the essential glamorous option total.

Move forward along with your app

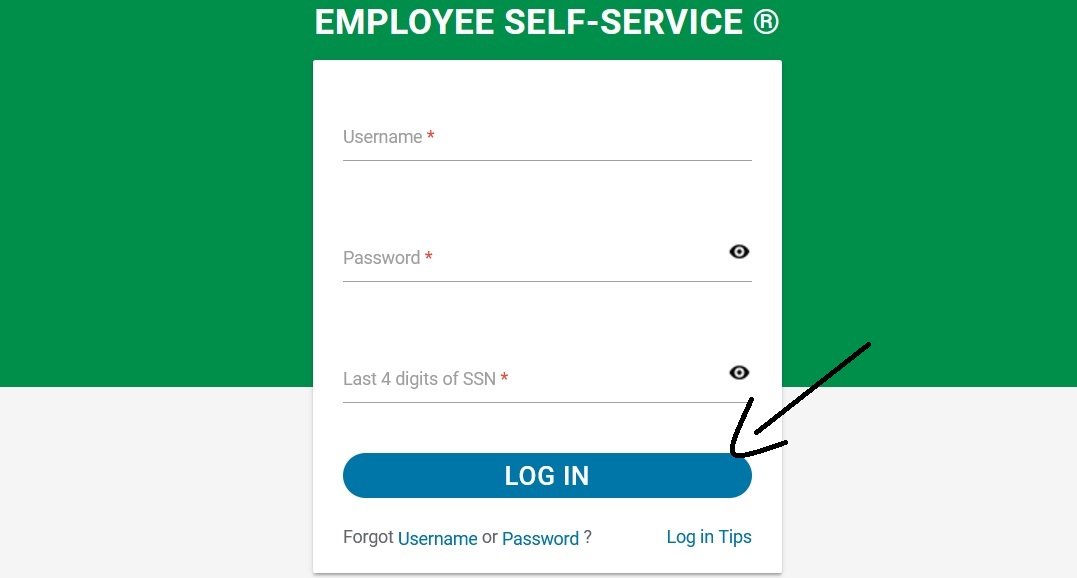

Once you have selected a lender, it is time to apply. You will have to provide the financial to the required papers and advice so they are able effectively process the application.

This may suggest giving them copies of your latest shell out stubs or W-2s, earlier tax returns, current financial statements, financial comments, copies of your identity, and much more.

Settling your property guarantee financing you are going to improve your bad credit

Property guarantee loan can get change your credit history by the diversifying the sorts of financial obligation on your own credit file. And you can, possible reconstruct your credit score with every towards the-go out percentage.

This will help you become approved with other finance along the range, and you will discover a diminished interest.