Replacing the new exterior

The exterior can give your residence an innovative new look, generally in your house’s outside. There are numerous options to pick from, and stone veneers, fiber-concrete siding, and you may plastic material exterior. The fresh new siding together with adds to the life of your house, as well as this type of alternatives will help you to recover more than 60% of the very first funding toward resale.

Finishing the fresh new basements

New basement enhances the available square area in the house, whenever you may have covered it precisely and made the necessary proofing against moisture, it does include value into household. This is because customers usually value any additional place they are able to rating inside the property.

Rooftop replacement

In the event that shingles are attaching, destroyed, or curled, you should know doing your roof. They contributes age to the strengthening, along with the best procedure, you could make the

Replace old screen

New windows together with freshen up the look of your house. They contributes value on household, instead of screen letting in the an excellent write. They also supply the possible opportunity to decide for time-effective screen, which rescue brand new citizen off high-energy expense.

Renovate a bathroom

The bathroom is an additional interior room you to definitely gets many notice away from prospective buyers. It is also necessary for your own morale just like the toilet are a location to select recreation, thus do not end up being bad purchasing several dollars additional.

We want to were sleek counters, add lights of course, if the house only has one to restroom otherwise one-and-a-half, imagine improvements such as for example a bath otherwise a 1 / 2 bath on guests’ dining room. Numerous real estate agent prices say you could potentially recoup no less than 52% of one’s initial financial support.

An informed do-it-yourself loan relies on your position. Usually, however, if you’re planning to finance specific developments or fixes in the domestic, then choose financing specifically designed for home improvements. Even so, area of the choices are suitable on various other circumstances. Is an introduction to the best places to use each solution.

Federal national mortgage association Homestyle loan This is the best loan for those who have higher level credit and can set up a considerable downpayment.

RenoFi Equity/HELOC money Talking about best for anyone who has a low mortgage rate closed for the however, who want to get loans getting recovery as they do not have so you can refinance again.

- RenoFi bucks-out refinances It is preferable if you are looking to take benefit of established lower-financial pricing in the present industry.

The main benefit of this type of expertise reount of money you can aquire. Its significantly higher than old-fashioned home improvement issues, being little more than personal loans.

Although not, if you can’t supply such, then solutions alternative makes it possible to safer some funds having the recovery. They’re also appropriate when you look at the different facts;

Cash-away refinances – As well as the situation that have those more than, this is actually the best choice if you are searching to take advantage of current lowest passions and alter other regards to your own financial.

House guarantee line of credit – Its a good idea when you yourself have numerous small ongoing strategies as they are not knowing about their specific funds.

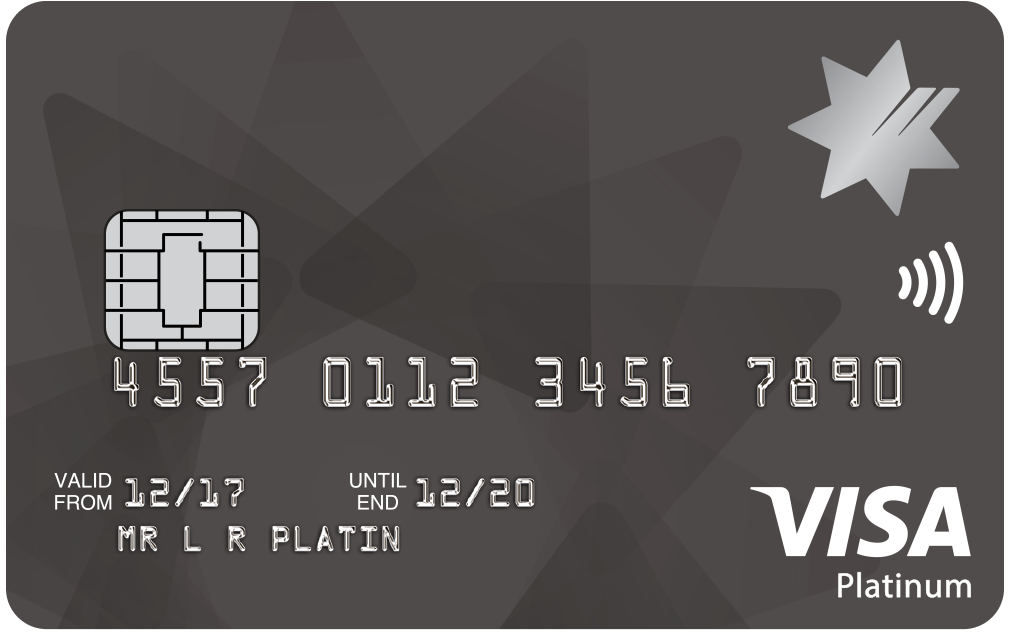

- Handmade cards – Only use a charge card for small-identity systems or emergencies. Also, pick both 0% Annual percentage rate or rating a consequent mortgage to repay the credit credit to get rid of the higher pricing.

8. Steps to own Trying to get a home Update Financing

The next thing is making an application for your home update financing. Listed here are procedures to follow along with https://paydayloanalabama.com/lake-view/ to own a delicate process. It tend to be tips having money that needs;